As Vice President Kamala Harris and Donald Trump vie for votes in the waning hours leading up to the 2024 Presidential Election, the Inflation Reduction Act (IRA Billl) is a concern on the ballot for many companies/investors, the climate and economy. This news roundup features articles about IRA tax credits, swing states economies and job markets, and more on the 2024 Presidential election impact on the Inflation Reduction Act:

Election Throws Uncertainty Onto Biden’s Signature Climate Law – Inside Climate News

In August, 18 House Republicans sent a letter to Speaker Mike Johnson urging caution in any efforts to reform or repeal the law, noting that its tax credits for clean energy “have spurred innovation, incentivized investment, and created good jobs in many parts of the country—including many districts represented by members of our conference.”

The IRA Bill’s design—which created, expanded or extended a wide array of tax credits for everything from wind and solar power generation to battery manufacturing, electric vehicles, clean hydrogen production and sustainable aviation fuel—has made it broadly popular among businesses big and small.

Swing states in US election are biggest winners in Democrats’ landmark climate bill – The Guardian

Two years on, the IRA has delivered “the biggest US economic revolution in generations – and it’s all because America finally, finally decided to do something about climate change”, said Bob Keefe, executive director of E2, a non-partisan business group.

Nearly half a trillion dollars in total public and private investment, when deployment of wind and solar farms is included, has occurred nationally, creating more than 300,000 new jobs. Clean energy now accounts for more than half of total US private investment growth, while jobs in the industry are multiplying at double the rate of the overall American economy.

How the Presidential Election Could Impact Renewable Energy Tax Credits – Power Magazine

President Biden signed the Inflation Reduction Act (IRA) into law in 2022. The IRA Bill is the largest public investment in renewable energy in American history and created more than 20 different tax incentives for renewable energy and related manufacturing.

Certain Republic politicians have directed vitriol at the IRA. However, even if Republicans win the White House in the November election, a repeal of the IRA is unlikely.

Nonetheless, a Trump administration could take a variety of executive actions to make developing and financing renewable energy projects more difficult. Easier options include declining approvals for projects on federal lands, revoking Internal Revenue Service (IRS) guidance, and revoking proposed Treasury Dept. regulations. More difficult options include freezing grant funding and revoking final Treasury regulations.

Sustainability Of Energy Stocks Is Clouded By 2024 Election Uncertainty – Investor’s Business Daily

Investing in energy stocks, be they traditional oil and gas companies or renewable startups, is not for the faint of heart. That’s especially true ahead of the 2024 presidential election. Wars — the shooting kind and the trade kind — can upend even the best strategies in unexpected ways. So can volatile commodity prices and government policy shifts.

Consider what happened after President Joe Biden’s signature climate law, the Inflation Reduction Act, squeaked through Congress in the summer of 2022. The IRA Bill provides hundreds of billions of dollars to hasten the transition to renewable energy. Many investors expected clean-energy stocks to soar and fossil fuel stocks to sink.

Instead, the opposite occurred. Renewable-energy companies were hurt by rising interest rates, inflation, supply-chain problems and consumer hesitancy about electric vehicles. Meanwhile, Russia’s invasion of Ukraine boosted oil prices and profits. U.S. oil production reached all-time highs. In the two years after the climate law passed, the iShares Global Clean Energy ETF (ICLN) dropped 37%. The Energy Select Sector SPDR Fund (XLE), dominated by ExxonMobil (XOM) and Chevron (CVX), rose 14%

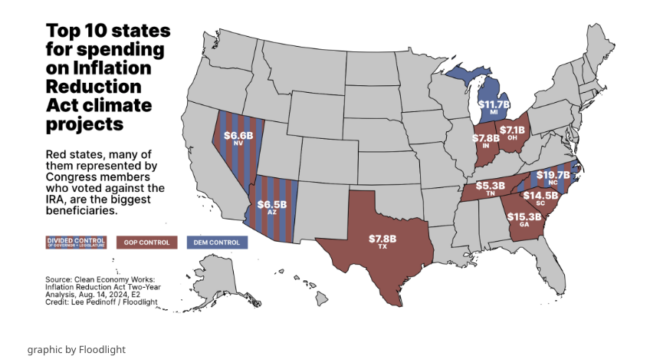

Renewable energy is catching up in red states, potentially bolstering IRA incentives – Daily Energy Insider

Climate change and renewable energy remain polarizing topics among politicians—at least on paper. New analysis from the Environment America Research & Policy Center suggests Republican-leaning states are deploying clean energy with increasing speed.

The longstanding gap between Democratic- and Republican leaning states’ adoption of clean energy resources has narrowed considerably, likely driven at least in part by the incentives created under the Inflation Reduction Act, according to Johanna Neumann, senior director of the campaign for renewable energy at Environment America. Texas is now the nation’s top state for renewable energy development, and although California still ranks second, Iowa, Oklahoma and Kansas round out the top five, she said.

US Economy Will Suffer If IRA Repealed, Solar Maker CEO Says – Bloomberg

Former US President Donald Trump has promised to end what he has called the “Green New Scam” on the campaign trail, a reference to Biden’s climate initiatives. However, a full repeal of the Inflation Reduction Act, which provides hundreds of billions of dollars in tax credits and other incentives for clean energy projects, would require approval by Congress, where it’s supported by Democrats and some Republicans.

“It’s a good thing,” Enphase Chief Executive Officer Badri Kothandaraman said of the IRA incentives in an interview late Tuesday. “It’s creating jobs and its bringing back manufacturing.”

Investors are ramping up climate advocacy, with all eyes on COP29 – Reuters

In the U.S., investors backed the historic IRA Bill – the largest climate and clean energy legislation in history – unleashing billions in clean energy investments nationwide and stimulating significant private-sector activity. Across the country, every $1 of federal investment from the Inflation Reduction Act has unlocked $5.50 in private investment, opens new tab. Now, investors need assurance that the Inflation Reduction Act is here to stay. Policy certainty is essential to give investors the confidence to commit capital and scale long-term clean energy projects.

Investors continue to call for access to consistent, comparable climate risk data to make informed decisions. All that hinges on standardized disclosure rules. The passage of mandatory climate disclosure laws in California and the adoption of regulations by the U.S. Securities and Exchange Commission were major victories for investors, but their focus has shifted to ensuring these policies are upheld and effectively implemented.

Supreme Court allows Biden to implement plan to curb carbon emissions from power plants – NBC News

The Supreme Court on Wednesday allowed the Biden administration at least in the short term to enforce its latest attempt to curb climate-harming carbon emissions from coal- and gas-fired power plants that contribute to climate change.

The court, which has a 6-3 conservative majority, rejected emergency requests brought by Republican states led by West Virginia and various industry groups seeking to block the regulation.

Why the Oil and Gas Industry Is So Afraid of Kamala Harris – New York Times

Fears about a paradigm shift away from fossil fuels also animate the industry’s pushback against predictions that global demand for oil and gas will peak by 2030. When the widely respected International Energy Agency issued that forecast in late 2023, citing governments’ policies to advance clean energy, major oil executives and their political allies lashed out in response. That included former Trump administration energy policy officials, who pledged to help push out the agency’s head if Mr. Trump is re-elected. Republican senators have threatened to withdraw funding from the I.E.A. unless it changes its forecasting approach.

Searching for a PR firm that has deep understanding of the IRA Bill (Climate Bill) and its impact on the deployment and advancement of clean energy projects and tech?

If you believe your brand would benefit from working alongside an award-winning climate tech PR and sustainability PR firm, please contact [email protected]

***Climate PR news roundup guest post from FischTank PR interns Baylee Matthews and Kaylee Seitz***